Equity

The power of quality investing

Back to all

In 1989, Warren Buffett first coined the famous phrase “it's far better to buy a wonderful company at a fair price than a fair company at a wonderful price”. We are not here to argue that this is the exact date of the emergence of ‘Quality Investing’, as Peter Lynch was already an outspoken investor with similar ideas around that time, and Buffett himself had been investing this way a few years prior. Nonetheless, it’s a landmark for this investment style.

Just as Quality Investing's birth date is fluid, so is its definition. There are no hard facts or a general convention as to what Quality Investing is. Investors use it as they see fit. However, recurring themes include superior characteristics in soft criteria, such as management and board of directors' credibility and capability; and hard criteria, such as high and stable profitability.

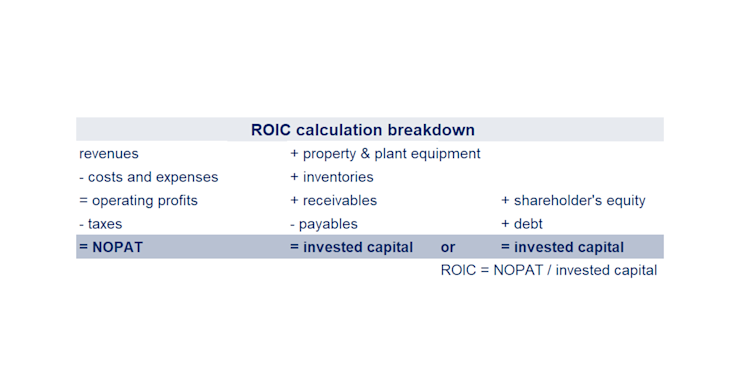

Return on Invested Capital (ROIC) is widely used by academia, companies' management, and asset managers to assess companies' (or projects') profitability and to judge their capital allocation merits. Here, too, there's some loose definition on how to calculate it, especially as the economy evolves more and more from tangible to intangible assets, creating misalignments between numerator and denominator—that's an interesting topic that deserves a chapter of its own. Fundamentally, the ROIC measures the percentage of the company earnings per dollar of invested capital—the higher, the better.

ROIC calculation breakdown

Source: DPAM, 2024

To make it more practical, picture a typical retailer—let's call it Retailer A. To build the business, Retailer A will need capital from shareholders and/or debtholders, which will be subsequently spent on acquiring real estate, furniture and fixtures, inventory, and a buffer for payables (suppliers) and receivables (credit for consumers)—that’s the denominator. The numerator is the operational profitability, meaning revenues from the goods sold minus the costs and expenses of operations—such as the cost of purchasing the goods, employees' salaries, marketing, etc.—and after taxes.

Consider now that Retailer A has competition: Retailer B. Both operate with 10 stores that were built by investing $100 in each. Because Retailer A has an exclusive and desired product, it can sell at a premium and generate $10 of annual profit, while Retailer B sells more general merchandise, limiting pricing power and thus making only $8 of profits. Retailer A enjoys 10% ROIC while Retailer B has 8%. That ROIC difference implies two things. First, it demonstrates an evident competitive advantage for Retailer A over Retailer B. Second, Retailer A has a bigger cushion of profitability that can be used to defend its competitive position against Retailer B in the dispute for preferential access to scarce resources, be it prime locations, physical goods, or human capital.

Furthermore, high ROIC is seen as a signpost for Quality Investing, meaning that a company with high ROIC and above its cost of capital (what equity and debtholders ask in return) might possess outstanding attributes.

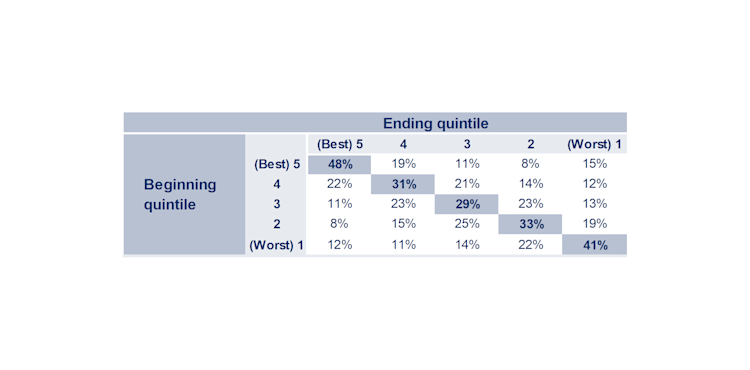

Having a high ROIC is a necessary but not sufficient condition in our investing process because these assessments are usually backward-looking. As close observers of the corporate world, we’ve seen wonderful companies fail to keep their laurels over time. The level of excellence of management teams is a crucial factor to assess, as they are the guardians for perpetuating the business qualities. Leadership can decline. The reverse path is less common—mediocre (or average) companies have a lower probability of breaking from their vices to become industry leaders. When we distribute companies across ROIC quintiles from worst (1) to best (5) and observe their ranking three years later, a large proportion of companies remain in the same quintile or fluctuate slightly to nearby categories. Excellence and mediocrity are deep-rooted identity factors with inherent inertia.

Transition rate from beginning to ending quintiles over a 3-year period, 1990–2022

Source: Counterpoint Global Insights “ROIC and the Investment Process”, 2024

What really matters to us are companies that can sustain or even improve their ROIC, or in other words, enhance their value-creation excellence. Companies that remain outstanding (or even push the boundaries) are our end goal and what we define as Quality. That means that more than current ROIC, we are focused on the path of ROIC, and that implies two things: 1) the sustainability of the current stream of cash flows—what we call “franchise” (ROIC); and 2) the incremental expansion and growth—the Return on Incremental Invested Capital (ROIIC). Defend what you own and attack what’s left. Profitably.

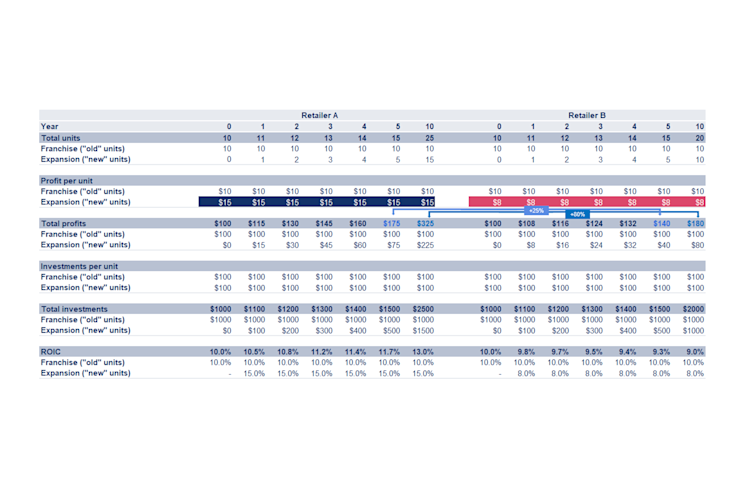

Returning to our fictitious retail example, imagine that they decide to open new stores with all the cash they are generating. Will it create value—in other words, will they achieve the same (or even better) returns as the older units? The new stores, meaning growth, will be opened in uncompetitive regions, in markets where consumers share similar habits. Can management handle the greater complexity of being a larger entity? Will these new stores create a halo around the brand and show the benefits of greater purchasing power? All of that, of course, assuming that the core—the older units' competitive dynamics—are under control.

Let’s tweak the previous example a bit for the sake of simplicity and comparison by removing the exclusive product advantage of Retailer A and say that each generates $10 of annual profit per store, enjoying a 10% ROIC. Let’s assume both will reinvest 100% of their profits in store expansion and the investment needed per unit remains $100. However, Retailer A found a new store format that is more productive or more appealing and is able to generate $15 of profit, while Retailer B entered a new geography, and it turned out that they can only generate $8 of profit because the market is more competitive than previously thought. After five years of ongoing reinvestments at a respective 15% and 8% ROIC, Retailer A's profits will be 25% higher than Retailer B's, despite starting at the same level. Assuming a similar multiple on their earnings, Retailer A's stock price would have performed approximately 5% more per year than Retailer B's—that’s a significant outperformance. Over five years, that's a 25% higher profit level and, due to compounding factors, over 10 years that's almost 80% more profit. In fact, this outperformance should be even higher, as companies with higher ROIC command a higher multiple, as investors are willing to pay more for the uniqueness of the business and the expected higher future growth.

Source: DPAM, 2024

Note that the different paths in profitability can be explained by microeconomic laws. However, in the background (or should we say at the helm) there's always an important element of human capital making these decisions and ensuring execution. As we always say: it’s a combination of businesses and people.

These are important considerations when looking at ROIIC—moreover, they are subjective due to the unknown. We are constantly required to make decisions based on partial information—ambiguous, sometimes conflicting and untrustworthy. We try to overcome this by extensive industry knowledge through specialisation, investing frameworks, discipline, and diversification. Still, it comes with uncertainty.

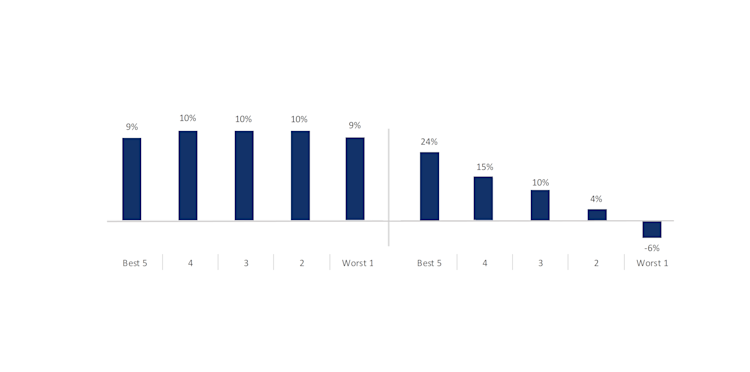

Empirical evidence supports our strategy to focus on the future ROIC (forward-looking), rather than just taking for granted the current ROIC (backward-looking). Companies ranked across ROIC quintiles deliver very similar returns on average over a three-year period. However, companies standing in the best quintile at the end of the three-year period have delivered the best performance over that same period. Future ROIC is the main driver of excess returns over time. Rising ROICs tend to be good for shareholders, and the opposite is true for falling ROICs.

Annual 3-year total shareholder return, 1990–2022 - ROIC beginning quintile [left];

Annual 3-year total shareholder return, 1990–2022 - ROIC ending quintile [right]

Source: Counterpoint Global Insights “ROIC and the Investment Process”, 2024

Shareholder returns are greater for mediocre companies (bottom quartile) that improve to outstanding (top quartile) than for outstanding companies that remain outstanding. That begs the question: why not focus on the bottom cohort—the ones where there’s “most upside”? The answer is threefold: 1) as previously outlined, those cases of mediocre to outstanding are less frequent than the outstanding status quo, and we like to fish in big ponds; 2) those mediocre companies usually need an external, less predictable force to act (new management, activist shareholder, etc.); and 3) we find it easier to predict and monitor outstanding companies and exit fast when there’s enough evidence of cracks in their excellence.

Excess returns for shareholders—the always desired outperformance—are ultimately the result of revisions in expectations. We can still achieve excess returns with top-performing ROIC companies that show resilience, the ability to reshape themselves, to maintain or improve their profitability. The most common debate we find in those situations is the longevity of their superior ROIC—the stability of the franchise (ROIC) and the growth opportunity (ROIIC). The current level of profitability and the pace of future growth.

How do companies deteriorate or improve over time? At the beginning of every failure, there is some sense of arrogance that creeps into the culture. As with many great things in life, culture takes a very long time to build, but it can be destroyed almost overnight. Over the long term, culture is the winning factor. It's talented and energised people who will nurture outstanding traits to keep generating above-normal ROIC (thus ROIIC). That’s why profitable growth, ROIIC, is important. Growth is the essence of any business. Decisions based on growth permeate companies with energy and vigour—a clear positive for morale and culture.

We are strong believers and practitioners of Quality Investing. Our investment strategy is anchored in the pursuit of outstanding businesses through meticulous research. We aim for companies with evident secular growth potential and enduring competitive advantages that safeguard high returns on invested capital, while maintaining minimal debt. We actively seek out businesses led by exemplary management teams who consider the interests of all stakeholders. This is the essence of our ‘Pillars of Proven Winners’ methodology—identifying companies that consistently create sustainable economic value, as reflected in their earnings per share growth, the primary driver of long-term share price appreciation.

Proven winners

Source: DPAM, 2024

Note that we mix backward- and forward-looking traits in our analysis. Two common questions whenever we are analysing a company: why do they make these levels of profit (or ROIC), and how can that continue and eventually improve (ROIIC)?

Disclaimer

Marketing Communication. Investing incurs risks.

The views and opinions contained herein are those of the individuals to whom they are attributed and may not necessarily represent views expressed or reflected in other DPAM communications, strategies or funds.

The provided information herein must be considered as having a general nature and does not, under any circumstances, intend to be tailored to your personal situation. Its content does not represent investment advice, nor does it constitute an offer, solicitation, recommendation or invitation to buy, sell, subscribe to or execute any other transaction with financial instruments. Neither does this document constitute independent or objective investment research or financial analysis or other form of general recommendation on transaction in financial instruments as referred to under Article 2, 2°, 5 of the law of 25 October 2016 relating to the access to the provision of investment services and the status and supervision of portfolio management companies and investment advisors. The information herein should thus not be considered as independent or objective investment research.

Investing incurs risks. Past performances do not guarantee future results. All opinions and financial estimates are a reflection of the situation at issuance and are subject to amendments without notice. Changed market circumstance may render the opinions and statements incorrect.